3 Ways to Teach Kids About Saving Money

When it comes to teaching kids about saving money, we start tapping into life skills that will follow them well into their adult years. Of course it’s important for them to have a foundation in math and reading (two of my favorite subjects), but there are other ways to bring this skill to life. Here are some innovative ways to teach your kids about saving their money and spending wisely.

3 Ways to Teach Kids About Saving Money

Before diving into my tips, I’d first like to say that you can never start too young. Kids are always watching our every move and although they may not have the vocabulary or thought capacity to come on out and ask about money, they’re watching. The following suggestions don’t have a specific age target. They can easily be scaled up or down to match the developmental needs of your kids.

Start talking about it.

Contrary to popular belief, talking about the realities of money with kids does not have to be hard. In fact, one of the easiest ways to start introducing the concept of saving money is to discuss wants and needs. This will help them begin to understand the value of money. Consider using everyday examples to show this concept, such as:

- The cost of food purchased to feed your family. Save your grocery receipts for them to look at.

- Explain that your home comes with a cost as well (regardless if you rent or buy).

- Show the bill statements that it takes to keep your house warm in the winter and cool in the summer.

You can also discuss clothing, gas, and healthcare costs. Do the same for showing wants (vacations, enjoying a restaurant meal, etc.).

Get these free money worksheets

Give your kids opportunities to earn their own money.

Once your kids begin to understand the value of money, it’s now time to help them understand the concept of earning it. Even if they’re not of job-age, you can start paying them an allowance for doing chores around the home. The American Institute of Certified Public Accountants (AICPA) reported that in 2019 kids earned $30 per week on average, based on five hours of chores. This is a great starting point for giving your kids experience with working, earning money, and learning how to save/spend it. Another life skill that is fostered here is showing kids the value of their hard work.

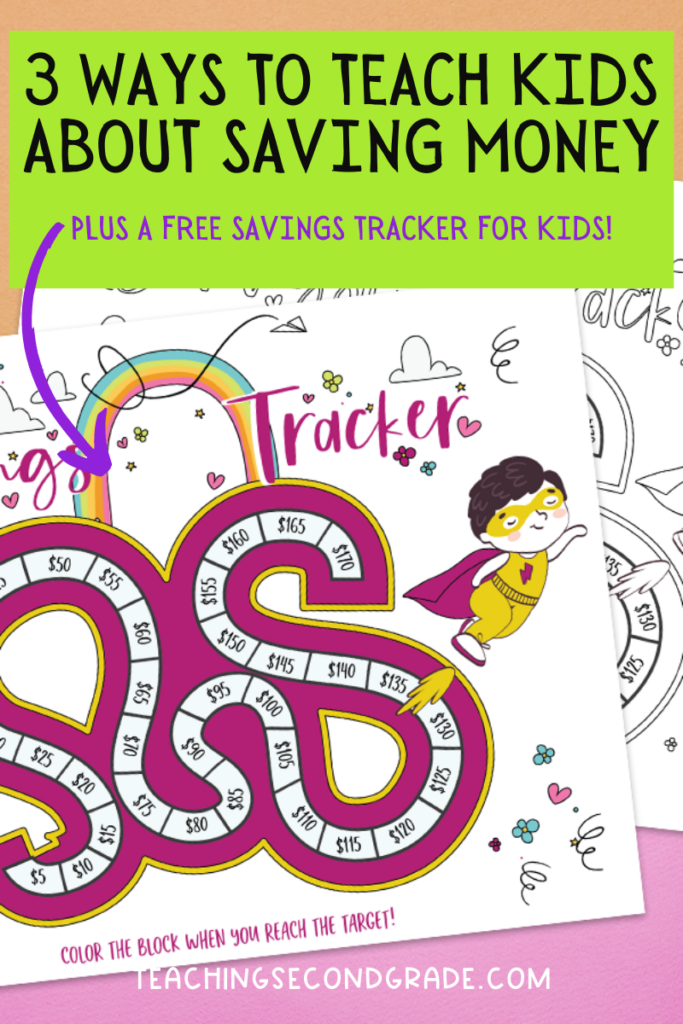

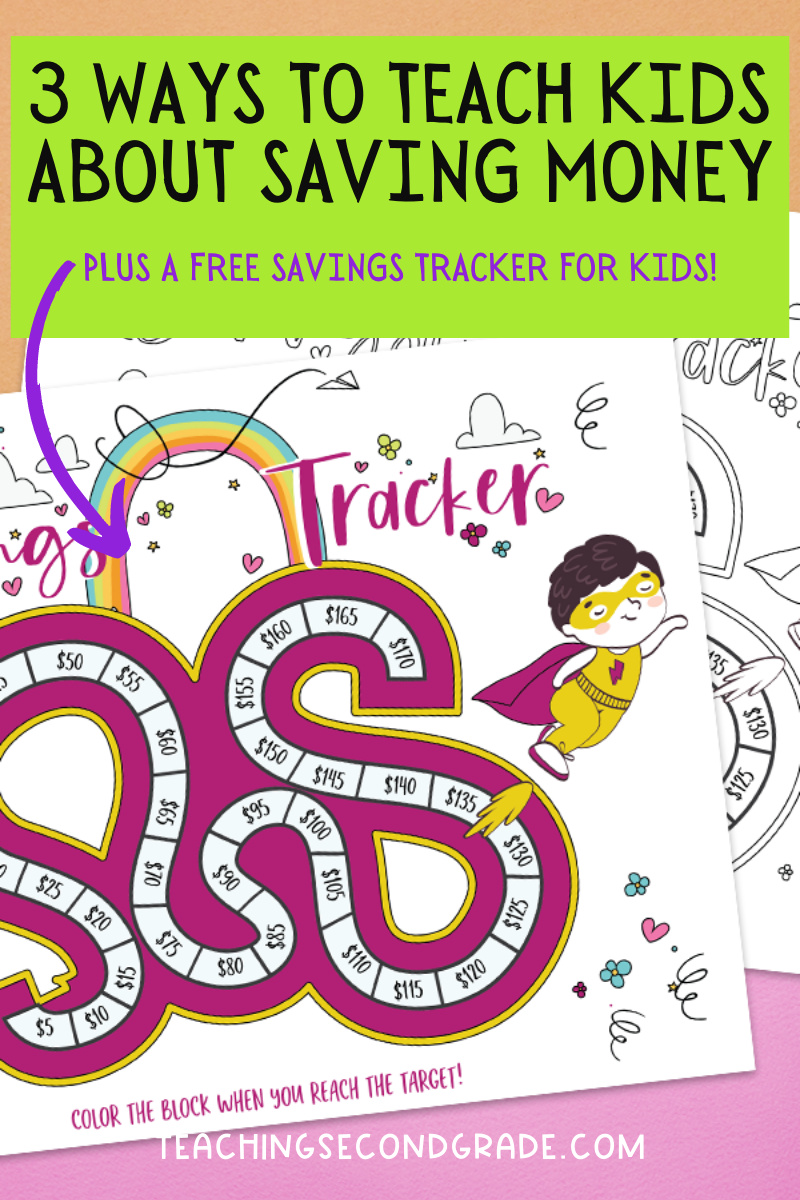

Use a savings tracker.

Once they’ve started making their own money, use a savings tracker as a visual to help them see how much they are saving. You may also want to help them create a list of their own needs and wants so they can see how much they’ll be spending and saving. Most of us adults use a checkbook register or ledger to keep up with our money, so using a tracker is an equivalent that kids can understand and easily use. Here’s a great roundup of videos to help teach about counting money.

Free Tracker to Teach Kids About Saving Money

If you’re looking for a way to help your kids learn about saving money, then you’ll want to get my free money saving tracker created specifically for kids! This tracker ascends in increments of $5 ending with a total savings of $170. Not only will your kids save lots of money, but you can also use the tracker to teach them how to add, save, and set goals. If there’s something special they’ve been wanting to get, have them write it on the tracker at the dollar amount needed to purchase it. Once they’ve reached that amount, they’ll be excited to be able to get it!

CLICK HERE TO GET YOUR FREE SAVINGS TRACKER!

Search

Hi there!

Thank you for stopping by, I’m so happy you found my little space. Take a look around and make yourself at home. Sign up for my newsletter below and you’ll receive the latest news and updates. Thank you!